nebraska sales tax rate finder

With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses. Reason for Applying select only one.

How To Register For A Sales Tax Permit In Nebraska Taxjar Blog

Amended Form 10 with Schedule 7-2021 Form 10 with Schedule 4-2021 for tax period April 1 2021 through June 30 2021.

. Business partner numbers are 4 to 7 digits in length Consolidated Sales and Use Tax Filing Number. Amended Form 10 with Schedule 4-2021 Form 10 with Schedule 1-2021 for tax period January 1 2021 through March 31 2021. Form 10 with Schedule 7-2021 for tax period July 1 2021 through March 31 2022.

Estimate capital gains losses and taxes for cryptocurrency sales Get started Comenzar en Español. Education Credit Deduction Finder. The use tax on these utilities should be paid via a PA-1 Use Tax Return or if you are required to file a sales tax return as part of that return.

Employers Address City State and Zip Code. Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes. If you have a regular recurring use tax liability on utilities you should register for a use tax account using the Online PA-100 at wwwpa100statepaus.

Know which dependents credits and deductions you can claim Get started. See which education credits and. Enter your employees W-2 with Nebraska income information into the spreadsheet.

Tax Accounting. If you use this number to report tax for the county where your business is located 2. Enter the Sales Tax License number used to report the use tax in the.

Florida Business Partner Number if registered. If you file a consolidated sales and use tax return County Control Number. Nebraska Withholding Account a valid Nebraska withholding account number must be entered do not enter 21- prefix in your state ID field Payment Year.

All fields are required except for Employee Middle Name. Amended Form 10 with Schedule 1-2021. Know what tax documents youll need upfront Get started.

Ord Nebraska S Sales Tax Rate Is 7 5

Sales Tax On Grocery Items Taxjar

Nebraska Income Tax Calculator Smartasset

Car Tax By State Usa Manual Car Sales Tax Calculator

Nebraska Sales Tax Small Business Guide Truic

New Jersey Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

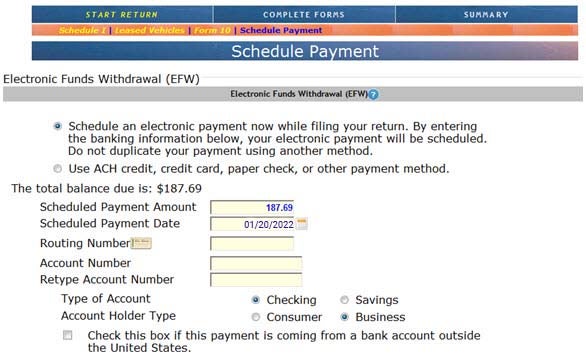

New Payment Option In Nebfile For Business Sales And Use Tax Nebraska Department Of Revenue

How To Charge Your Customers The Correct Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Nebraska State Tax Tables 2022 Us Icalculator