michigan sales tax exemption industrial processing

The State of Michigan allows an industrial processing IP exemption from sales and use tax. Nonprofit Organization with an authorized letter issued by the Michigan Department of Treasury prior to June 1994.

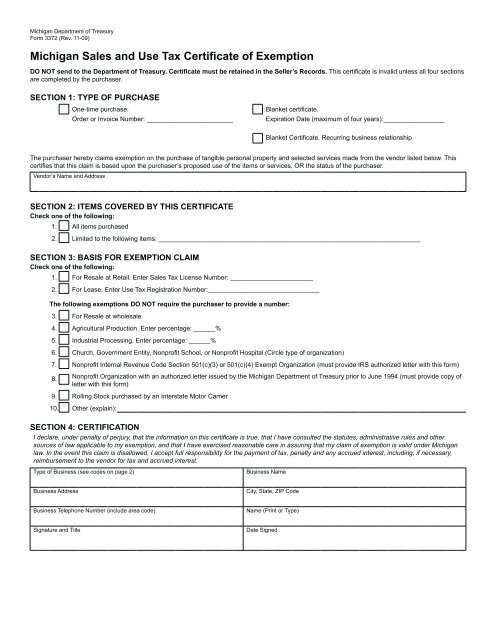

Mi Dot 3372 2021 2022 Fill Out Tax Template Online Us Legal Forms

The industrial processing exemption is limited to specific property and activities.

. If you answered yes to both questions your PPE and safety equipment purchases likely qualify for sales and use tax exemption. The Acts were based on Michigan Administrative Code Specific Sales and Use Tax Rule 40 1979 AC R 20590 and significantly expanded the exemption. However if provided to the purchaser in electronic.

But there is a significant exception for property used in industrial proces. This tax exemption is authorized by MCL 20554t 1 a. Industrial processing does not include the generation transmission or distribution of electricity for sale.

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Your federal determination as a 501 c 3 or 501 c 4 organization. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption.

However on the upside since the labs sale of dental restorations will now be considered by the Michigan Department of Treasury as a sale at retail dental labs may now claim the industrial processing exemption for qualifying supplies. Michigan Utility Sales Tax Exemption. The claimant generally provides an exemption certificate to the supplier of the utility showing the amount that is exempt.

However persons and organizations that are not part of the University and. The court had concluded that the taxpayer was engaged in industrial processing since it. Several examples of exemptions to the states.

All fields must be. 4225 exempt businesses which might not be eligible for industrial processing exemption covering purchases of protective gear and will help businesses buy certain. Nonprofit Internal Revenue Code Section 501c3 or 501c4 Exempt Organization.

Ad Sales Tax Exemption Michigan information registration support. This Revenue Administrative Bulletin RAB specifically addresses application of the sales and use tax industrial processing exemption to personal protective equipment PPE and safety equipment used to prevent the spread of infectious diseases such as COVID-19. At month end prepare Michigan sales and use tax report and forward to the Financial Operations by the 8th calendar day.

Sales Tax Exemptions in Michigan. In order to claim exemption the nonprofit organization must provide the seller with both. Michigan defines industrial processing as the activity of converting or conditioning tangible personal property by changing the form composition quality combination or character of property for ultimate sale at retail or for use in the manufacturing of a product.

Industrial processing also does not include the receipt or storage of raw materials extracted by the user or consumer or the preparation of food or beverages by a retailer for retail sale. The Michigan Supreme Court held that sales of container bottle and can recycling machines and repair parts qualify for the states sales and use tax exemption on machinery used in industrial processing. Industrial Processing is defined in MCL 2119M as.

The industrial processing exemption is limited to specific property and activities. On the certificate be sure to include the percentage of energy use claimed for industrial processing. SOM - State of Michigan.

1999 PA 116 and 1999 PA 117 the Acts clarified and expanded the industrial processing exemptions in Michigans sales and use tax acts. On July 20 2020 the Michigan Department of Treasury released a bulletin allowing PPE to qualify for the industrial processing exemption. This page discusses various sales tax exemptions in Michigan.

The General Sales Tax Act defines industrial processing as the activity of converting or conditioning tangible personal property by changing the form composition quality combination or character of the property for ultimate sale at retail or for. Generally Michigan imposes a 6 tax on purchasers of tangible personal property. City of Bay City.

Michigan offers an exemption from state sales tax on the purchase of electricity natural gas and water used in qualifying production activities. Purchasers may use this form to claim exemption from Michigan sales and use tax on. Personal protective equipment PPE or safety equipment purchased by an individual engaged in industrial processing activity is considered exempt from Michigan sales and use tax so long as the equipment is used in industrial processing activities.

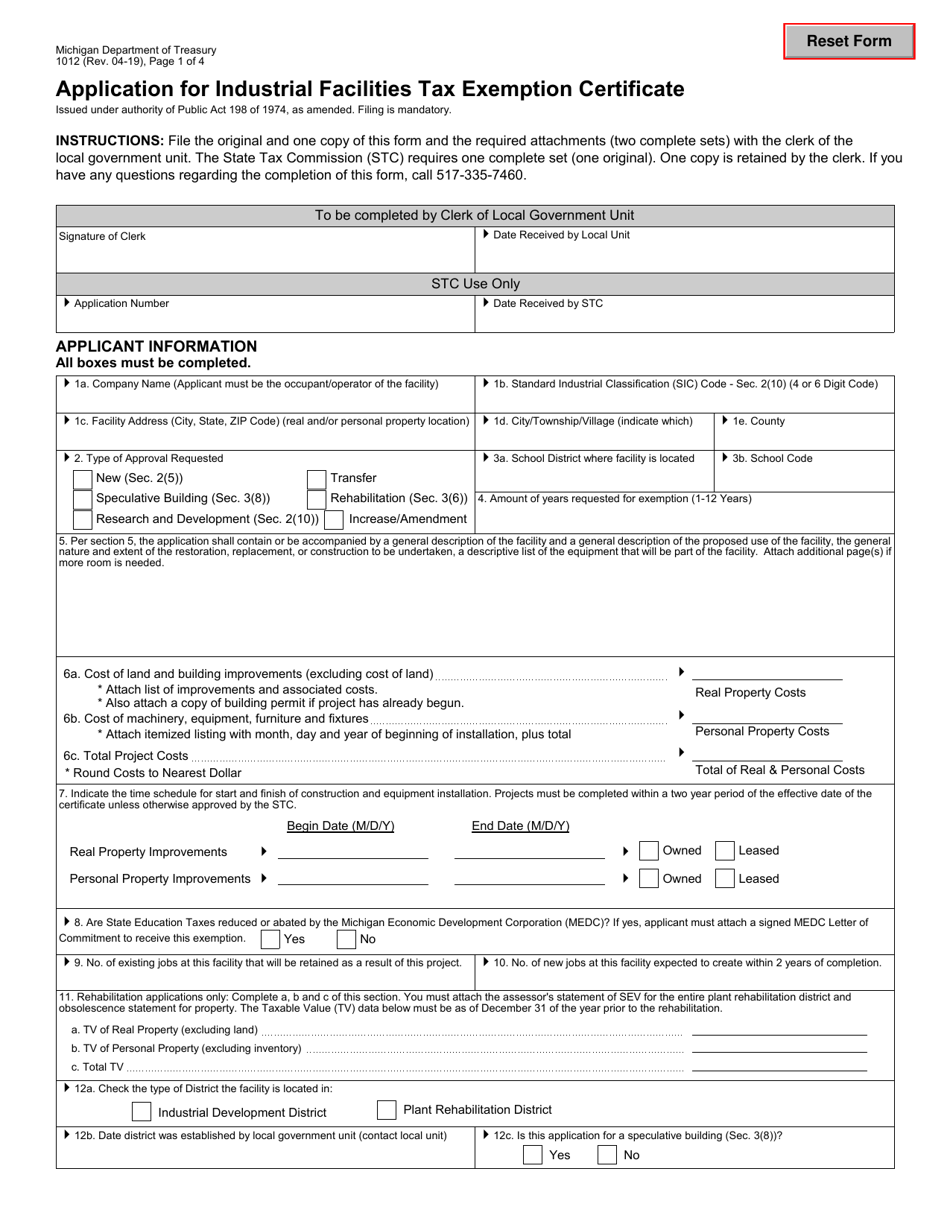

General Sales Tax Act MCL 20554t7e. The University of Michigan is exempt from sales and use taxation. An Industrial Facilities Exemption IFE certificate entitles the facility to exemption from ad valorem real andor personal property taxes for a term of 1-12 years as determined by the local unit of government.

Purchased by an individual whos involved in industrial processing on. Box 19001 Green Bay WI 54307-9001 or fax it to 800-305-9754. Of Treasury Industrial.

Nonprofit Internal Revenue Code Section 501c3 501c4 or 501c19 Exempt Organization. New State Sales Tax Registration. That term as defined in section 4t of the general sales tax act 1933 PA 167 MCL 20554t or section 4o of the use tax act 1937 PA 94 MCL 20594o.

Sales or rentals for industrial processing or for agricultural production. The Michigan Department of Treasury DOT had argued that the tasks the container-recycling machines perform occur before the industrial. Either the letter issued by the Department of Treasury prior to June 1994or.

Manufacturers and industrial processors with facilities located in Michigan may be eligible for a utility tax exemption. Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing. Applications are filed reviewed and approved by the local unit of government but are also subject to review at the State level by.

Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. The exemption certificate is 3372 Michigan Sales and Use Tax Certificate of Exemption. Manufacturing businesses pursuing a sales tax exemption from Bay City Electric should complete Form 3372 and submit to.

The GSTA and UTA generally define industrial processing as the activity of converting or conditioning tangible personal property by changing the form. As the end of the year approaches and thoughts turn to tax filings auto suppliers should keep the industrial processing exemption in mind. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

The Michigan Department of Treasury is requiring that Dental Labs collect and remit sales tax beginning July 1 2017. Send a Michigan Sales Tax Certificate to Michigan Gas Utilities Customer Service PO. Michigan bills HB.

Michigan allows businesses to claim an exemption on the portion of their utility used in industrial processing which includes but is not limited to production or assembly research development engineering re-manufacturing and storage of in-process materials. The Central Michigan Cementing Services decision held that a taxpayer that provided custom cement and pumping services to oil and gas well companies qualified for an industrial processing exemption and was exempt from use tax on its purchases of materials. Its important to note that this now applies to employee purchases and not just the exempt.

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption For Manufacturing

Form 1012 L 4380 Download Fillable Pdf Or Fill Online Application For Industrial Facilities Tax Exemption Certificate Michigan Templateroller

Michigan Sales Tax Exemption For Manufacturing

Mi Sales Tax Exemption Form Animart

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales Tax Exemption For Manufacturing